School Leadership Academy, Ghana

In May 2022, the EduFinance team facilitated its first School Leadership Academy (SLA) workshop in Ghana. The aim of the workshop was to bring together school owners with financial institutions to share knowledge about the benefits and opportunities to access school improvement loans, with guidance on how schools can improve their bankability and grow sustainable quality schools.

Schools offering low-cost student fees often have limited resources and their school leaders may have limited business and financial management skills necessary for growing a sustainable school business. The recent School Leadership Academy provided training to 175 school owners across two regions in Ghana (Accra and Takoradi). The workshop sessions covered basic financial skills, the importance of record keeping for business planning and loan applications, and discussed the types of initial investments schools could make to begin building a path toward sustainability. Attendees also heard pitches from EduFinance financial institution partners about their financial products and services, including school improvement loans and school fee loans available to their parent community.

We interviewed EduFinance Technical Assistance Advisors Robinah Zawedde and Richard Amuzu about the process of organizing this academy, and the learnings that came out of it.

What are the aims of the School Leadership Academy?

Robinah: The School Leadership Academy (SLA) in Ghana is a strategy that was put in place to support unbanked schools. We realized that there were a number of school leaders who either do not know that there are services or products that can support them to run sustainable businesses or develop their schools, and then there are also those that have tried to access finance but have failed. Our focus is to make sure we are supporting them to have the right financial tools in place so that they will be able to acquire a school improvement loan.

Richard: Part of helping them to build capacity is to also create a common platform where the financial institutions (FIs) can meet with schools to build pipelines and to see how best they can support them. When we do technical assistance with FIs, they ask about how they can market their support. We encourage them to take part in the Association of Private Schools’ meetings so that they can do presentations about the EduFinance product. The SLA made it very easy for them as they are able to make a pitch about their opportunities and create some pipelines [of potential borrowers] and then afterwards we are also able to share further information with them.

How did you coordinate invitations? What was the initial response and level of interest?

Robinah: One of the very important areas is our collaboration with the Private School Association. Firstly, they helped us identify the low-cost schools we were looking for. Richard did a lot of work, working very closely with the leaders of the Private Schools Association. They see this as an opportunity and reach out to their school proprietor members who they have been working with for a long time. They also know the dates when the school proprietors can be available, so they support us to understand when we can do the training and we also agree with them on a convenient venue for everyone.

It’s been amazing seeing staff from the Private School Association arrive early, before 7am, because they want to make sure that any school that has been invited has actually attended. This also supports the attendance of the school proprietors: I want my leaders to see me there and on time.

Richard: The relationship that we have built with the School Association has been a useful one. We collaborate with them and then they organize their members for it, and it is exciting news for them. Believe me when I say this - there is one cluster region that has also come back very strongly and they have been calling me since trying to see how we can do a similar SLA for them. They said they saw this process in news stories and from their colleagues in other regions and they are looking forward to Opportunity EduFinance doing the same for them.

How many schools ultimately attended?

Robinah: The first session took place in Accra with 86 schools attending, and after this, the Private School Association then pushed and requested another session in a different region because they saw the value, so we had the second one in Takoradi, with 89 attending Some of them are totally new to the financial tools, and many of them do not have any opportunity to speak to the banks.

Can you give a brief overview of the workshop agenda and session topics covered?

Richard: We have a structured approach and cover four topics:

1. What is a school improvement loan?

2. Why could it be beneficial for my school?

3. How do I apply for a school improvement loan?

4. How to manage finances (basic knowledge in bookkeeping)

We bring our FI partners together and then we interview them about what financial support they offer and what their criteria is, what other documents the school needs and what advice would they give for first time applicants. So basically, it’s an interaction and then after that we give the floor for the participants to ask questions.

What types of feedback did you get on the workshops?

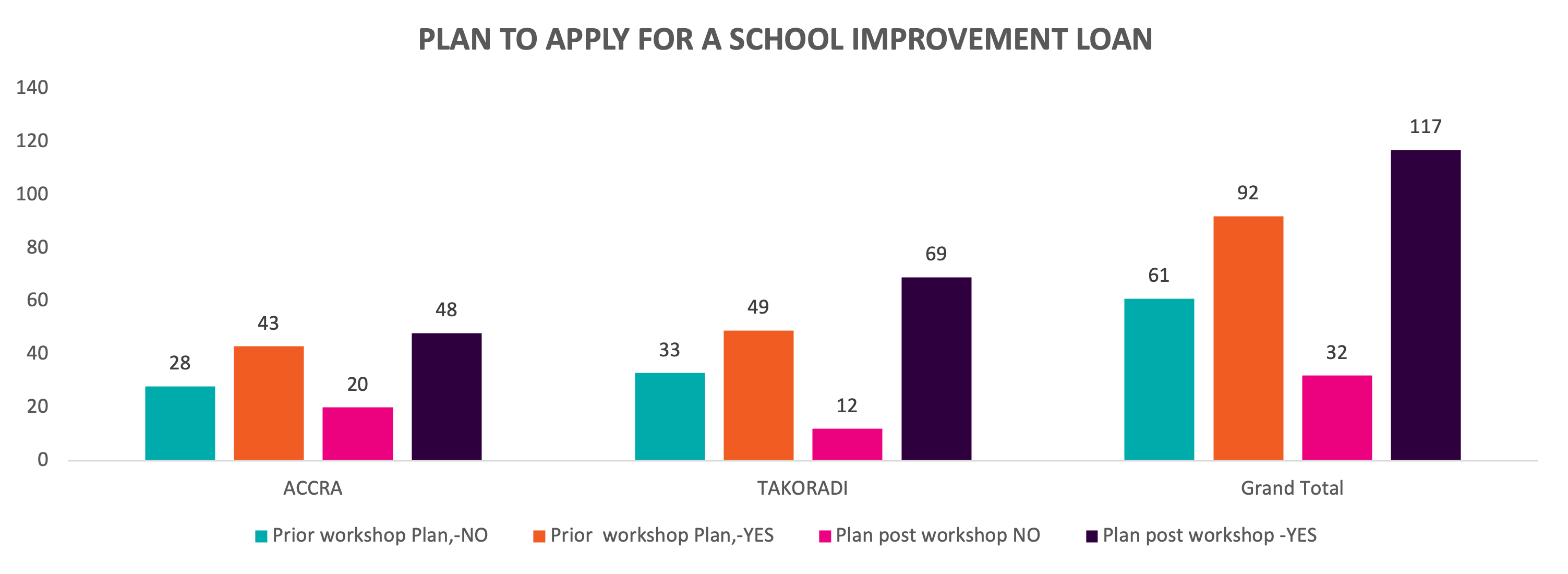

Robinah: We have two surveys. One is a basic school profile and the other one is the feedback survey. In the first one we try to capture information about the school before the training starts in the morning. The feedback completed at the end includes questions around their intentions to apply for a loan. It’s amazing to find out that many of the proprietors did not think about a loan before attending, but after the sessions almost 79% said that they now want to apply for a loan.

We also ask things like what are the likely challenges that you've been facing. This is very helpful for us to see where we can support them next time, but also great information that we can give to the financial institutions. We discover that they actually have a lot of challenges, they want help with dealing with high interest rates, there’s a lot of need to improve infrastructure so many of them talk about new classrooms and this is really great information and great data for us to know and share.

After the training we heard from the FIs that the school leaders were reaching out to them directly for loans, so the SLA has already successfully achieved this.

Can you describe the financial institutions' panel discussion?

Richard: I moderated the panel discussion, so I asked them about what they look out for and why they are interested in supporting schools. Across the panel, everybody talked about wanting to support schools and to create impact and then also to increase their portfolio for profit. Another key thing we talked about is the association plan. Most of these schools are managed by one person and if they are not in place the school doesn’t function effectively, so they encouraged them to have an association plan and an advisory board in place to help the school manager operations.

What were your overall takeaways as facilitators?

Robinah: It’s been a great opportunity to see that we are supporting these school proprietors. Some of their schools are very very small so creating an opportunity for them to have conversations with financial institutions is something that is really changing their lives. You realize that some of them are not familiar with even very simple financial tools. The SLA has really shown the school proprietors that being in control of their financial processes, books and management is a stress reliever. They can see the value of keeping their books right, they see why they missed a loan the last time or why they might not be able to get a loan. Now they see that as long as they keep their books in place, they can run their schools sustainably.

Richard: In summary, what I want to say is that SLA it’s a very good project that Opportunity EduFinance is embarking on. I believe that this will add value to the financial institutions, and they are also super excited because we are making their job much easier. I think the FIs are also appreciative of what we are doing. The future looks promising because we’re able to give all of these schools an understanding of what the FIs have to offer them, and I know it’s a very good thing so let’s keep it up!

To learn more, read our blog about Opportunity EduFinance's history of work in Ghana