What We Do Oikocredit Partnership

OIKOCREDIT & OPPORTUNITY EDUFINANCE PARTNERSHIP

ABOUT THE PARTNERSHIP

The Opportunity International & Oikocredit Education Finance Collaboration aims to address the lack of capital released into the education sector in low-income countries. Increasing capital released will enable independent local schools to provide affordable, quality education and help parents access the resources necessary to send their children to school.

Founded in 1971, Opportunity International is headquartered in Chicago, Illinois, US, and Oikocredit, founded in 1975, is headquartered in Amersfoort, Netherlands. Both Opportunity International and Oikocredit work in more than 30 low- and middle-income countries around the world.

OIKOCREDIT & OPPORTUNITY EDUFINANCE VALUE ADD

This collaboration is unique given both Opportunity International’s & Oikocredit’s breadth of experience (more than 90 years combined) and common experiences and objectives.

The technical assistance provided by Opportunity's EduFinance program to partner financial institutions focuses on the on-lending of Oikocredit’s capital support to the education sector. This capital is essential for scaling up EduFinance loan products and providing deeper impact for schools and communities in the target countries. By providing Opportunity's signature EduFinance programing and increasing Oikocredit’s lending footprint, the collaboration builds on the proven success of combining tailored lending with training and support for financial institutions and schools. The project is specifically designed to work with the financial institutions and the schools who serve low-income communities that often have the greatest need for access to affordable, quality education.

This proven combination of training and capital support has yielded social and financial returns greater than those of any isolated lending, training, or support efforts. The collaboration is expected to unlock critical resources to improve the access to and quality of education for an estimated 2.2 million children across 6,600 schools in our target countries.

2023 YEAR IN REVIEW

Through our partnership with Oiko we've accomplished something truly remarkable: disbursing a substantial $40 million in loans to 15 financial institutions. This significant milestone not only reflects our shared commitment to financial empowerment but also emphasizes our collective dedication to providing children with accessible, high-quality education.

As we celebrate this success, let's also take a moment to reflect on the journey that lies ahead. In 2024, we're setting our sights even higher as we strive to mobilize more capital and expand our reach into Southeast Asia. By broadening our horizons and forging new partnerships, we're poised to make an even greater difference in the lives of children and communities across the region.

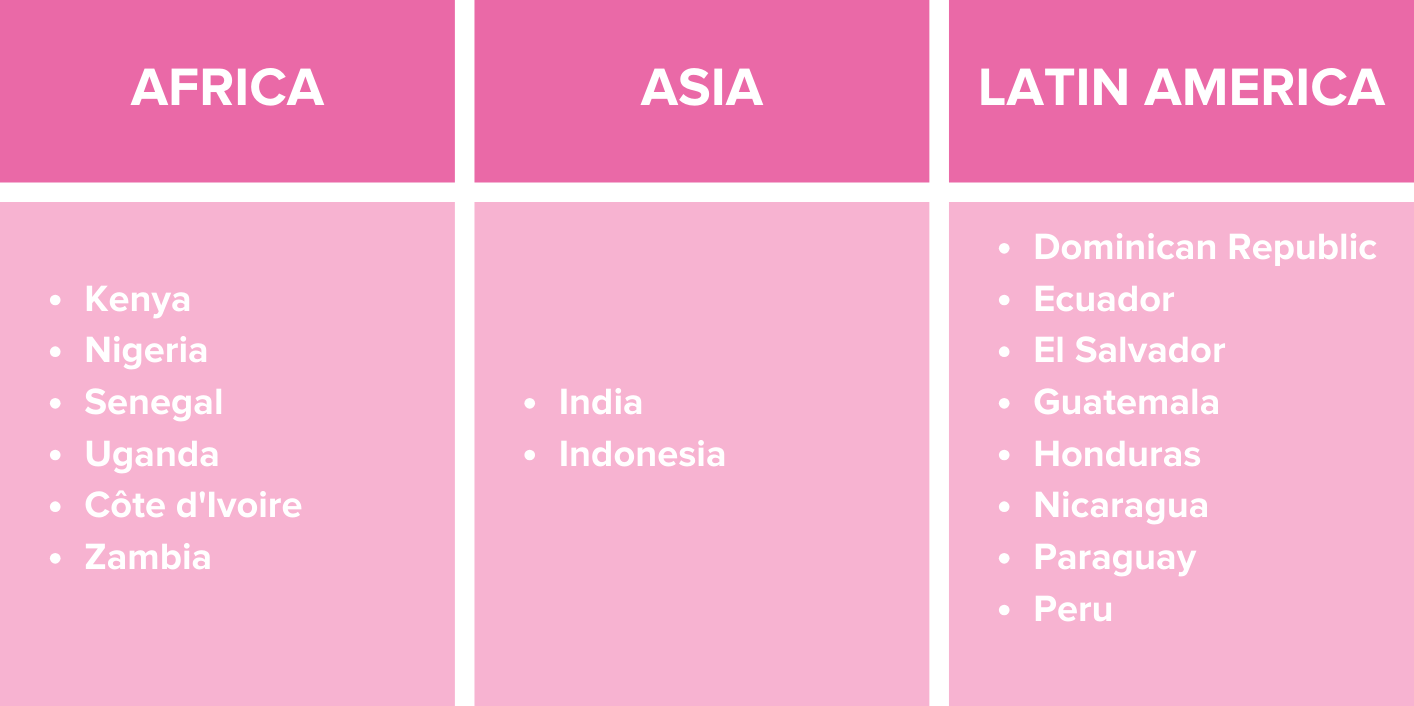

WHERE WE WORK TOGETHER

THEORY OF CHANGE

The role that impact capital can play in under-resources markets and the part that Opportunity International can play to increase the funds mobilized alongside our programs drives the collaboration. The journey is long and has global implications: an estimated US$200 billion is needed to meet the SDG#4 (Quality Education) alone. This partnership aims to support these goals and contribute to closing the global education funding gap.

FAQs

Q: How does the partnership work?

A: Through this collaboration, Opportunity EduFinance and Oikocredit will target financial institutions who serve the needs of vulnerable populations in select low-income countries. Once identified, Oikocredit will provide financial capital and Opportunity will provide technical assistance to support financial institutions to develop EduFinance portfolio.

Q: How will financial institution investees under the collaboration deploy the capital to further education?

A: Financial Institution investees will use the funding to launch and grow education sector lending products, likely:

- Loans to schools to fund new classroom construction, washrooms, dormitories, and purchase assets like school buses.

- Loans to parents to pay tuition costs for students, reducing absenteeism and drop-out rates for students when family income hits a shock or is irregular.

It is the intention of this collaboration that the available impact capital will result in either new or existing financial institution investees either entering or materially increasing its funds mobilized into the education sector in low-income communities, reducing the investment gap.

Q: How can schools qualify for funding?

A: The collaboration agreement incorporates both joint selection and marketing efforts by Oikocredit and Opportunity International. Through the investee due diligence process, the collaboration’s impact capital will be deployed into financial institutions that are most willing and able to deploy capital into the education sector serving low-income communities. The investment decisions for each school will be undertaken by the financial institution investees, using Technical Assistance support and tools provided by Opportunity International.

Q: Will the Oikocredit / Opportunity collaboration focus on families who live in extreme poverty?

A: The immediate impact of this collaboration will be seen in the advancement of education for children who live in poverty and extreme poverty and in improving the quality of schools that will be able to reach more students. This will be done by working with missionally aligned FIs.

Under the terms of the partnership agreement, both organizations will target financial institutions serving the needs of the most vulnerable populations within low-income countries, providing financial capital and training in support of the development of the education sector in these markets.

This collaboration will enable critical resources including school improvement loans for classrooms, washrooms, dormitories, teachers, and transportation; support school leaders with financial products to make instruction more effective; and provide loans for school fees and tuitions to keep students in the classroom. It is, however, only possible to support the schools who serve low-income families by aligning Oikocredit's and EduFinance’s work with those financial institutions who share the same mission of reaching these underserved communities.

WHO WE'VE WORKED WITH TO DATE

Standard Life

SidianBank

SEAP

ADISA

Coop Aspire

Cooperco

Adicla

Grace & Mercy

Fortune Credit

JCS

EdPartners Africa

Ebbo Sacco

Fortune Credit

Orabank Benin

Vista Bank

Baobab

Yehu

PARTNERSHIP CONTACTS

![]()

Mathieu Fourn - Director of EduFinance Technical Assistance (UK)

![]()

Alvaro Ma Romero - Global Senior Investment Officer (Netherlands)

REGIONAL CONTACTS

![]()

Sakshi Sodhi - Senior Technical Assistance Advisor, India

Divya Behl - Senior Associate for India

Julius Emmanuel Omoding - Senior Technical Assistance Advisor for Uganda and Kenya & Regional Director

Ali Touvnel - Technical Assistance Advisor for Senegal and Côte d'Ivoire

Jane Aik - Technical Assistance Advisor for Nigeria

Lucy Kabalisa - Technical Assistance Advisor for Zambia and Kenya

Richard Amuzu - Technical Assistance Advisor for Ghana

![]()

Carlos Natareno - Investment Manager Central America and the Caribbean

Gouri Sankar Gollapudi - MD, Maanaveeya Development & Finance (Oikocredit, India)

Caroline Kamau-Mulwa - Regional Director, Africa

Ufuoma Eghwerehe - Country Manager, Nigeria

Yves Komaclo - Investment Manager (Côte d'Ivoire)