Publications Key Insights

Data is central to EduFinance’s work. Through rigorous data analysis and monitoring results, we are able to identify key areas of success, points for improvement and generate new ideas efficiently. In addition to publishing larger research studies, we want to share these key insights resulting from our ongoing data analysis, recognizing that lack of data is often a barrier to developing new, evidence-based innovations that can collectively benefit the global education sector.

Midline classroom observations suggest improvements in teaching practice quality, with 58% of schools recording improved year-on-year scores.

Midline classroom observations were conducted in Year 2 of the EduQuality 3-year program and found most schools (58%) with a baseline and midline had improved their average scores, ranging between 67%-42% improvement across countries.

Evidence of promising improvements in teaching practices and lesson plan use, while formative learner assessments are still underutilized

Change in teaching practice has been positive, explicitly situating the lesson within the curriculum, and making more real-life connections to learners’ lived experiences. While classroom observations found leaders over-estimate their teachers’ regular use of lesson plans, teachers observed with prepared lesson plans in class increased from 22% to 43% between Year 1 and 2. However, despite the role that formative assessments can play in adaptive teaching, only 15% of leaders report teachers use formative assessments, indicating significant room for improvement in this area.

Schools are reporting incremental improvements in school management best practices, while opportunities for further improvement are evident

Analysis of School Management data indicates a larger percentage of partner schools in the EduQuality program are now reporting use of best practices, such as improvements in new teacher recruitment practices, increased provision of feedback to learners and more awareness of families’ price sensitivity.

Schools make significant 'quick win' improvements in quality between first and second years of EduQuality programme

Schools making 'quick win' investments in the area of School Culture have increased the average self-assessment scores for 50% of schools. This includes writing behaviour management policies, setting clear rules and expectations for learners, collaborating with other schools, providing extracurricular activities and even holding more frequent staff meetings. Other more challenging areas for improvement, such as the provision of an inclusive education policy, may be more difficult to achieve in the short-term.

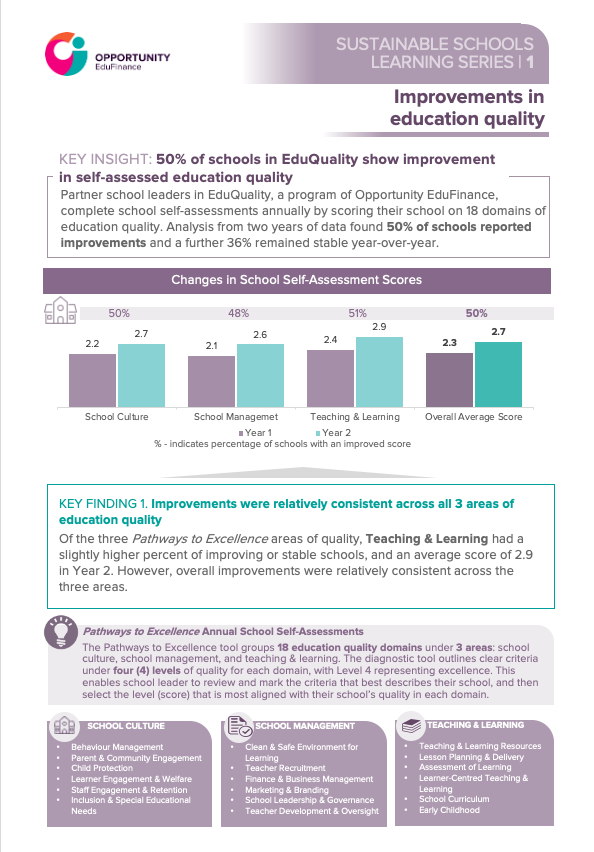

50% of schools in EduQuality show improvement in self-assessed education quality

Partner school leaders in EduQuality, a program of Opportunity EduFinance, complete school self-assessments annually by scoring their school on 18 domains of education quality. Analysis from two years of data found 50% of schools reported improvements and a further 36% remained stable year-over-year.

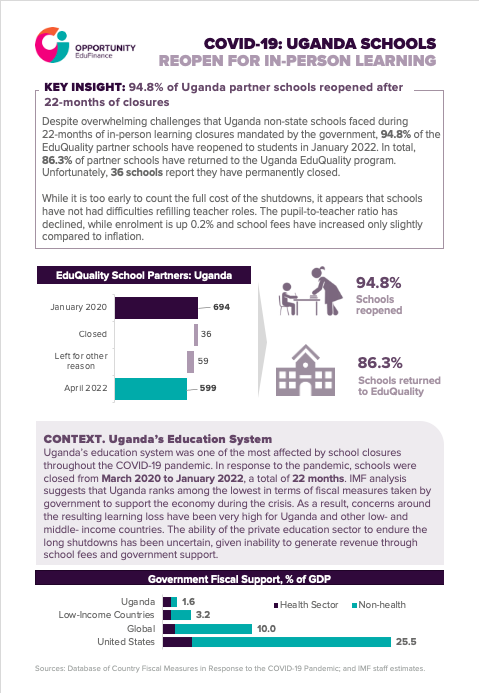

94.8% of Uganda partner schools reopened after 22-months of closures

Despite overwhelming challenges that Uganda non-state schools faced during 22-months of in-person learning closures mandated by the government, 94.8% of the EduQuality partner schools have reopened to students in January 2022.

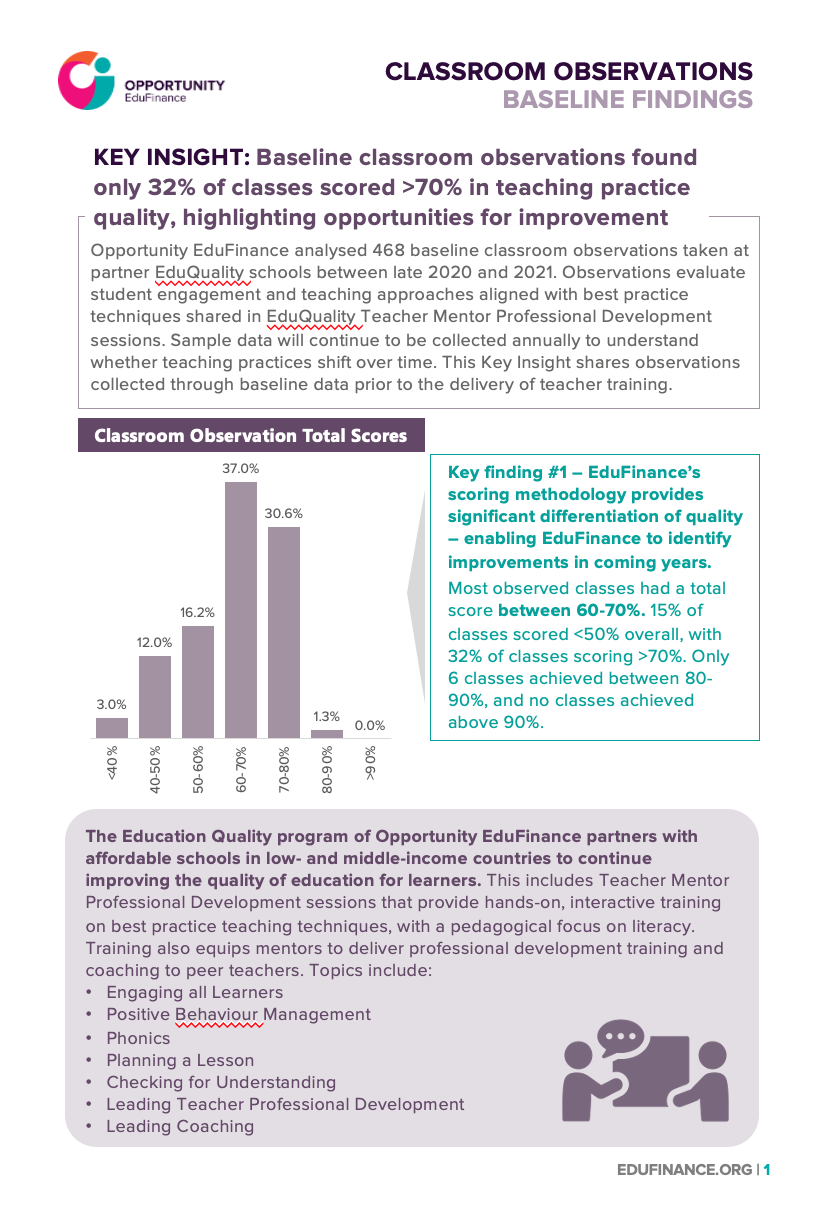

Baseline classroom observations found only 32% of classes scored >70% in teaching practice quality, highlighting opportunities for improvement

Opportunity EduFinance analysed 468 baseline classroom observations taken at partner EduQuality schools between late 2020 and 2021. Observations evaluate student engagement and teaching approaches aligned with best practice techniques shared in EduQuality Teacher Mentor Professional Development sessions.

More EduQuality partner schools are demonstrating an increase in effective school management practices

Survey data collected from affordable non-state school leaders in the Education Quality program shows early evidence of more schools beginning to use effective school management practices.

3 in 4 EduQuality partner schools are affordable to low-income families.

Opportunity EduFinance has developed a country-specific framework to define a ‘low-fee non-state school.'

The role of non-state schools in early childhood education

A new report published by the World Bank demonstrates the ongoing gap in access to childcare & preschool, and the role that is left to the non-state sector to fill if given adequate access to capital to grow.

Rwanda schools prioritize investment in income generating projects using education finance

Data from Rwanda schools in the EduQuality program shows school owners with loans have overwhelmingly invest in productive assets, increasing cashflow, sustainability and the capacity to improve the quality of education.

Schools, teachers and parents are facing immense challenges as a result of the Covid-19 pandemic

EduFinance surveys found that most school stakeholders have been negatively affected by this pandemic, facing significant income decline.

School leaders are embracing digital communication channels to engage EduQuality content

Survey data shows 77% of Rwanda school leaders reported using both Facebook and WhatsApp to access EduQuality content on school crisis management, and 95% used the digital EduQuality Pathways to Reopening guide.

Schools with loans improve education quality faster

Data shows schools that have taken School Improvement Loans are improving their education quality self-assessment scores at a 19.5% faster rate than those who are not banking with a financial institution.

Non-state schools support refugee students

Survey data shows 37% of non-state affordable schools linked to EduFinance financial institution partners provide education to refugee students.

$56M worth of additional future annual income generated by School Fee and Tertiary Tuition loans

Opportunity EduFinance financial institution partners have generated $56 million worth of additional future annual income for students through disbursements of School Fee and Tertiary Tuition Loans, meaning parents and students recoup 47% of their investment annually.

School Fee Loans decrease absenteeism

Households borrowing school fee loans report lower student absenteeism rates than households that did not borrow.

For every US$1 invested in EduFinance Technical Assistance, financial institutions lend US$64 on average

Analysis finds spend on EduFinance technical assistance leverages limited resource to provide greater child impact through education lending

Schools were unprepared to manage a crisis when COVID-19 forced closures

School leaders report struggling to balance their concerns about their finances with the welfare of staff and ability for children to learn while at home

Schools & learners have limited online access for learning during COVID-19

Connectivity rates for schools highlight the need for a broad approach to support learning during school closures in low tech / low resource environments.

EduQuality schools access more loans & have lower portfolio at risk than school borrowers not in the program

Evidence suggests the Education Quality program drives longer-term relationships between school owners and financial institutions.

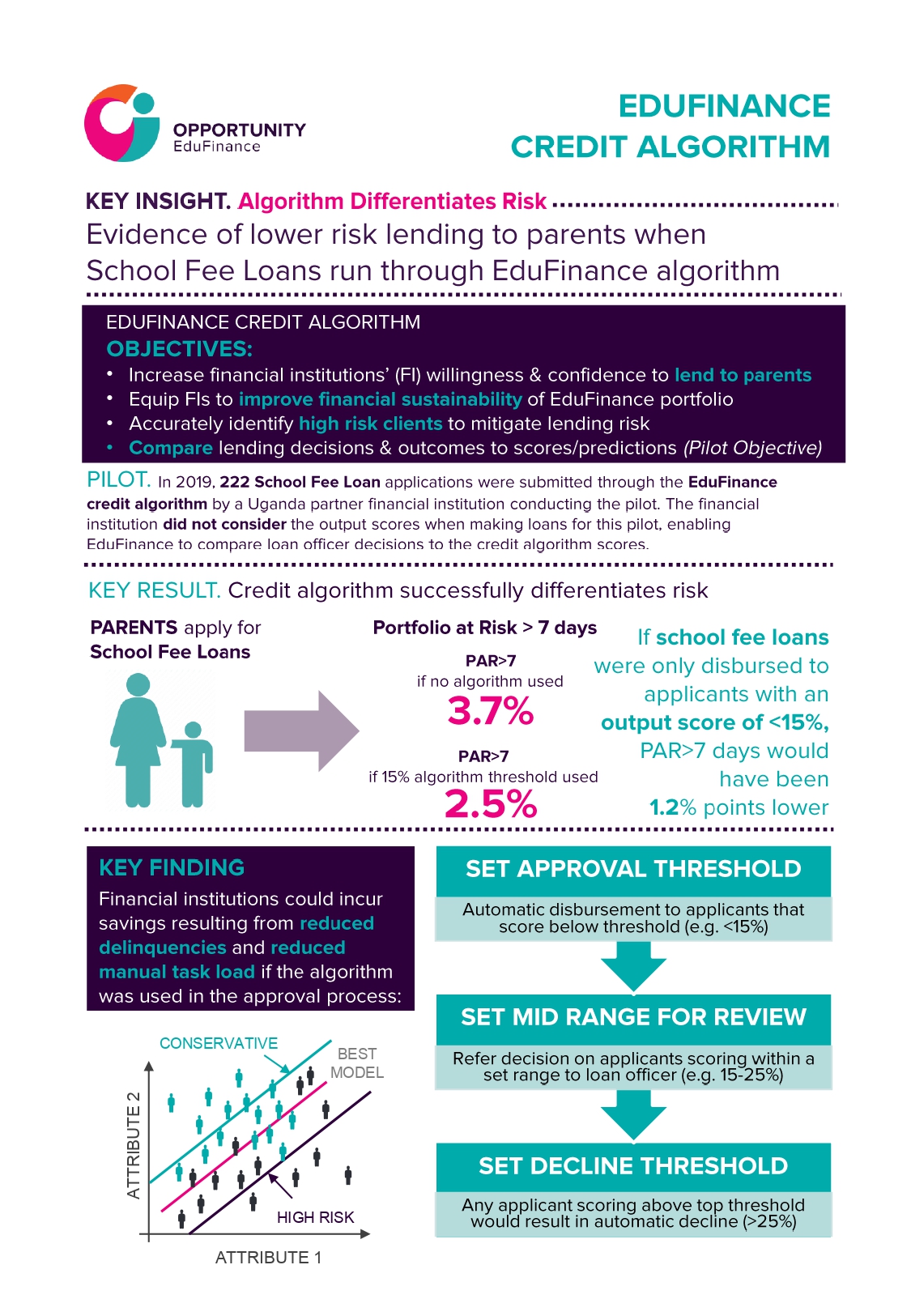

School Fee Loans run through EduFinance algorithm show lower risk lending to parents

There is evidence of lower risk lending to parents when School Fee Loans are run through the EduFinance Credit Algorithm.

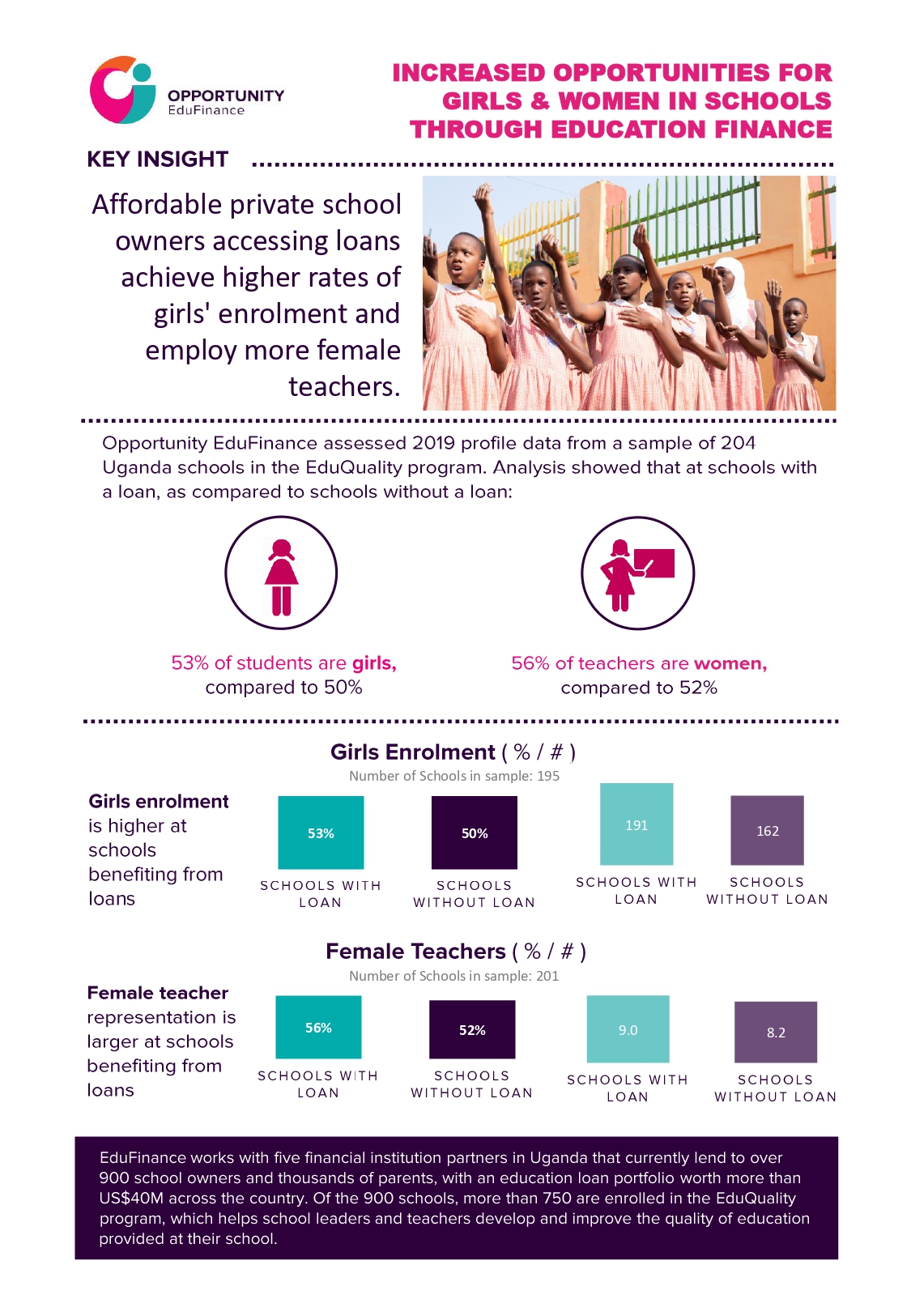

Increased opportunities for Girls and Women in Schools through education finance

Affordable private school owners accessing loans achieve higher rates of girls' enrolment and employ more female teachers in EduFinance partner schools enrolled on the EduQuality program in Uganda.

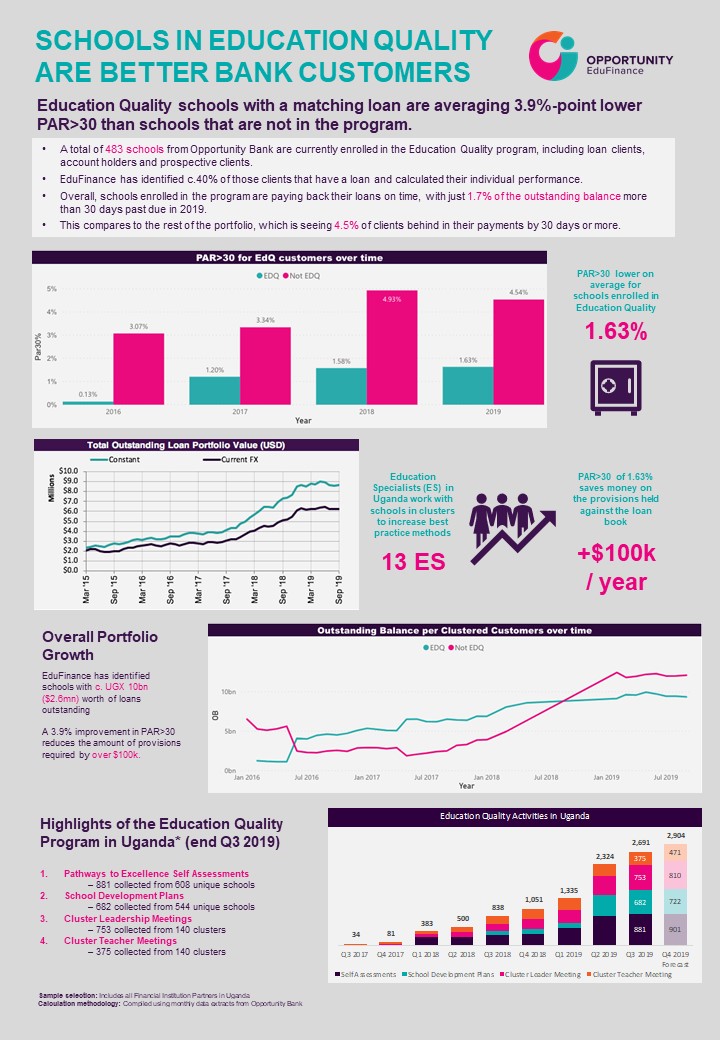

Schools in EduQuality are better Bank Customers

Schools in EduQuality with a matching loan are averaging 3.9% point lower PAR>30 than schools not in the program