Learning from Shared Experience - EduFinance Virtual Workshop

Before the pandemic began, the education sector in low- and middle-income countries was perceived as a rewarding market by many local financial institutions, a factor that helped Opportunity EduFinance grow its financial institution partners from 11 to 71 in under 5 years. However, the pandemic has adversely impacted the sector with school closures, lockdowns, and reductions in household income, affecting some schools’ ability to maintain a sustainable business. Nevertheless, despite the challenges of the past 15 months, financial institutions have continued to show a willingness to invest in the affordable non-state school sector, expressing optimism about post-pandemic opportunities.

SNAPSHOT OF FINANCIAL INSTITUTION PARTNERS’ EDUFINANCE LENDING: 2020-2021

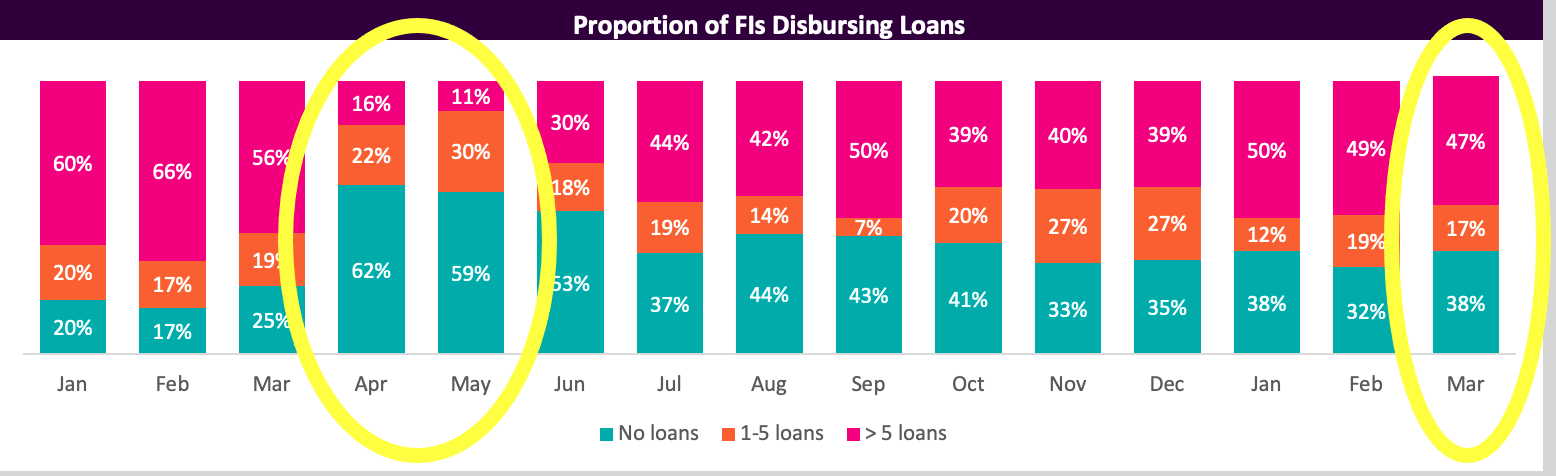

EduFinance partner disbursements to schools and parents slowed dramatically when the pandemic started, but picked up in the first quarter of 2021.

- January 2020 was a peak in terms of value and volume of loan disbursements.

- From April to May 2020, almost all activity stopped.

- The remainder of 2020 saw mixed performance with many financial institutions starting to lend again, but many others did not.

- As of March 2021, some financial institutions remain hesitant, but others have resumed lending. The first three months of 2021 have shown promise – while value and volume remain below 2020 levels, it is rising and materially higher than the end of 2020.

LEARNING FROM SHARED EXPERIENCE: GLOBAL PARTNERS WORKSHOP

In May 2021, the EduFinance Technical Assistance team brought together senior management from 54 of its partners across Africa, Asia and Latin America for a series of virtual interactive workshops facilitated by 11 EduFinance expert facilitators. More than 120 attendees participated in the workshops covering experiences, challenges and solutions in providing EduFinance products and services during the pandemic and beyond.

The workshops focused on three key questions:

- What was the operational experience of financial institutions during the first year of the COVID-19 pandemic?

- What were the strategic changes that financial institutions employed to address the challenges during that period?

- What are the strategies and market opportunities for education finance going forward?

The key finding of the workshop was that there was no one-size-fits-all strategy that worked. Interestingly, there was no ‘typical’ country-wide strategy, as approaches and solutions differed among financial institutions in the same country. Instead, we found similar strategies were employed across different regions and depended more on the target market and institutional capacity of the financial institutions than on the country itself.

The following highlights other key findings from participants' sharing during the workshop around the key questions. The full post-workshop report is available for download here.

%20(1).png)

What was the operational experience of financial institutions during the first year of the COVID-19 pandemic?

- Many financial institutions reported an increase in parents and students seeking financing for technology. This trend occurred globally. However, some financial institutions reported that demand for finance actually decreased due to drops in family income. Families that would have sought financing for e-Learning gadgets for all their children could now only afford one for all their children to share.

- Interestingly, in Latin America, demand for saving products increased during the pandemic and parents were more likely to save for education than to take a loan.

- In East Africa, several partners introduced emergency loans for parents and teachers.

- In South Asia, financial institutions reported that the demand for school fee loans reduced, but with still some demand, as schools required parents to pay a portion of the fees due. Other financial institutions stopped all disbursements during lockdowns.

“My key takeaway was that education is a priority and should never be compromised. I learned that we (the world) are in this fight together; my perspective was broadened!” - Njideka Nwabueze, Group Head Education Sector, Sterling Bank, Nigeria.

What were the strategic changes that financial institutions employed to address the challenges during that period?

"The pandemic was an opportunity to completely transform our business model from traditional infrastructure finance to a school relationship model." - Anand Krishan, COO, Indian School Finance Company, India

- The most commonly chosen option was moratorium, loan restructuring or arrears management (66%), followed by digitalisation initiatives (61%) and product changes (45%).

- Across all regions, partners focused on communication with existing clients. Financial institutions took up the role of communicating practical information on social distancing, safety, school reopening, stress testing to their EduFinance clients.

- Many financial institutions increased the bandwidth of their call centres and social media response so that customers could have their concerns easily addressed without having to travel to branches.

- Financial institutions took a mixed approach to both disbursements and collections.

“Across our entire portfolio we listened to our clients and agreed on repayment schedules aligned to their reduced earning capacity. We built a weighted model to understand the likelihood of loan recovery considering geographies, sectors, and other factors. We didn’t have access to government support, but were able to offer grace periods of 6-12 months using our internal resources.” - Katty Kanashiro, Business Manager, ABACO Peru

- Unsurprisingly, almost all financial institutions mentioned digitialisation as a strategic initiative, with the approach dependent on the size and handling capacity of the financial institution and the target market it served.

- The shift to digital marketing and social media began before the pandemic, but has become more pronounced and is expected to last.

- There was a shift from seeing loan officers as ‘dispensable’ and using incentives based on the number of loans disbursed to offering more holistic support for staff and changing incentives to focus on customer relationships.

- To address the new needs of clients during the pandemic, financial institutions launched new products or tweaked existing products. Cosami Guatemala, for instance, developed an instant loan so that clients could buy technology. Parents could access a loan up to US$1,200 with approval within 30 minutes. The feedback from the clients was very good and PAR is still close to zero.

“Our success was based on accepting that the crisis was there to last. Accepting meant that we couldn’t do anything but innovate. One of our challenges was changing our operational model from paper to digital. We changed our credit applications so that clients could apply for loans on our website and all documentation could be sent virtually.” - Luis Perez, COSAMI Guatemala

What are the strategies and market opportunities for education finance going forward?

Following analysis of the planned strategies and experiences discussed, the EduFinance Technical Assistance team synthesized the following recommendations for future strategies for education finance lending:

- Study market to growing and rebuilding EduFinance portfolios: Market segmentation studies will help financial institutions grow or rebuild education portfolios and understand which segments should be focused on during periods of uncertainty. Underwriting must be adapted and alternative methods of credit assessment may be more useful than relying on historical data. Refining digital marketing strategies will help financial institutions increase outreach.

- Diversify holistic EduFinance product offerings: Diversification of products will enable financial institutions to continue to support the education needs of clients while diversifying risk during school closures. EduFinance recommends exploring products that cater to the entire education ecosystem, such as financial services for teachers, suppliers, vocational and skill development institutions, as well as savings and insurance products.

- Implement digital financial services to enhance client relationships: Partnering with Fintechs or developing app-based solutions can addresses significant pain points for parents and schools. An additional advantage is that it provides financial institutions additional insight into a school’s cashflow, which helps in assessing their risk profile and repayment capacity. However, investments into such products can require significant investment or internal capacity building. Financial institutions can start by offering trainings virtually using social media or by hosting webinars. Specific to schools, valuable trainings on business planning, cash-flow analysis and stress-testing enhances school client relationships while improving the resilience of the school business.

- Develop partnerships to expand outreach and increase competitiveness: It is important to invest in partnerships that help financial institutions stay competitive in an increasingly digital market. EduFinance sees significant partnership opportunities in the following areas: co-lending with commercial banks to increase outreach (where a smaller financial institution and commercial bank lend to the same customer through one loan), partnerships between traditional ‘brick and mortar’ financial institutions and fintechs to upgrade credit scoring solutions and increase outreach, and partnerships with mobile money operators, agent networks and other digital payment channels that will enable financial institutions to diversify product offerings and offer flexible payment solutions.

Despite COVID-19 related challenges, the growing, unmet demand for non-state education is expected to pick up in the short- to medium-term, especially given the reductions in public spending on education as countries struggle with the economic burden of the pandemic. Opportunity EduFinance appreciates the important role that financial institutions play in filling these significant financing gaps, and our partners’ willingness to share their experiences, strategies and lessons learned for the collective good. We hope that the findings and recommendations synthesized from these workshops will encourage more investment into the affordable non-state school ecosystem in low- and middle-income countries.

__________________________________________

Opportunity EduFinance’s Technical Assistance Facility (ETAF) supports access to affordable education by working with financial institutions that provide financial products to the education ecosystem. The ETAF team is made up of finance experts based in Europe, Africa, Asia and Latin America who provide a variety of technical assistance and expertise. To date, the ETAF team has worked with 71 financial institutions in 25 countries who have collectively disbursed over US$413mn in loans.