Using Credit Algorithms to Expand Access to Education Finance

Opportunity EduFinance’s mission to get more children into better quality schools uses the principles of ‘financial inclusion’ to drive our work. Financial inclusion is simply defined as ‘the availability and equality of opportunities to access financial services.’ Yet the challenges to achieving financial inclusion are wide ranging and require us to consider new innovations to change the status quo. We see this broad reach in the Sustainable Development Goals, where ‘financial inclusion’ is reflected as a target in 8 of the 17 goals.

In the education space, we know what financial inclusion can look like:

- Parents have access to school fee loans for education expenses at the start of a school term, especially when household income fluctuates, ensuring children aren’t sent home or forced to drop out.

- School entrepreneurs have access the school improvement loans they need to build additional classrooms for a growing school, or add gender separated toilets, creating schools that benefit the whole community.

So what innovations can help us further expand access to education financing? Helping financial institutions to identify and understand risk can lead to lower borrowing costs and fair treatment of customers. EduFinance has recently developed and tested a credit machine learning algorithm for financial institutions to utilize in their education lending credit approval process. Initial analysis from our pilot in Uganda found evidence of the potential to reduce the risk of lending to parents when school fee loan applications are run through the EduFinance algorithm.

Why use a credit algorithm in Education Finance?

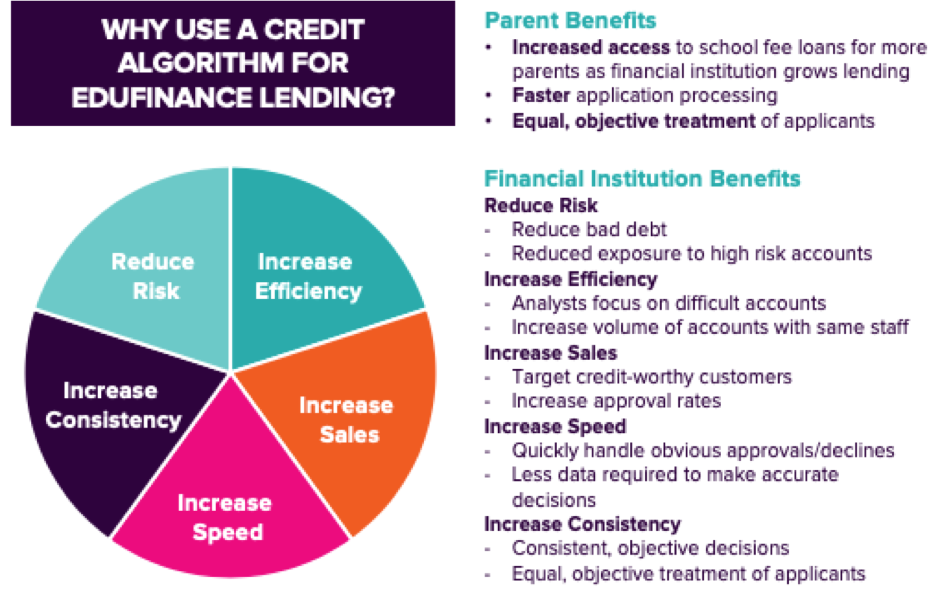

EduFinance believes the role of loan officers and credit committees in the lending process remains essential. The goal of utilizing a credit algorithm is to simply improve the accuracy and efficiency of the loan assessment process. While there are numerous potential benefits to a financial institution, it is important to first highlight the potential benefits for parents and school entrepreneurs.

Education finance loan applicants (parents & school entrepreneurs) can benefit from a faster application process. They can also benefit from equal, objective and transparent treatment based on the algorithm output scores. By fairly and reliably differentiating credit-worthy from very high-risk clients, financial institutions may increase their willingness to lend to parents and school entrepreneurs requiring vital capital. See our $24billion Opportunity Report for more information on the global demand for education financing.

For financial institutions, the benefits are clear. If better credit decisions are made more efficiently, a financial institution can generate higher revenues and lower losses. When the growth of a quality, sustainable education finance portfolio is in the best interest of a financial institution’s bottom line – even beyond its social impact commitments – parents and school entrepreneurs benefit from increased access and market competition. Figure 1 below outlines key benefits for parents and financial institutions.

Figure 1: Why Use a Credit Algorithm for EduFinance Lending?

What is the EduFinance Credit Algorithm?

Before discussing the findings of the first EduFinance credit algorithm pilot, it is necessary to review some the high level relevant concepts.

- An algorithm is a sequence of computational steps which takes input values and transforms them into an output.

- A credit algorithm is a credit scoring model which assesses potential borrowers’ credit worthiness based on large data-sets of customer and market information. Unlike traditional credit scorecards involving subjectivity, the credit algorithm uses objective results and historical loan outcomes data to predict which clients are most likely to be creditworthy, as well as which clients have characteristics that are closely linked to default.

- Machine learning refers to a set of statistical methods that can automatically detect patterns in data and use those patterns to predict future data. As financial institutions build up large databases of customer behaviour, managers and credit analysts can base decisions on increasingly reliable information provided by a credit algorithm.

Supported by funding from the Bill and Melinda Gates Foundation, the first iteration of the EduFinance credit algorithm was implemented with financial institutions in Uganda where a significant amount of education finance data was available to train the first models.

The EduFinance credit algorithm was developed for both school fee loans, which are generally small 3-6 month loans taken by parents to cover their children’s education related expenses, and school improvement loans, which are larger SME sized loans for school entrepreneurs needed for capital improvements or working capital.

- The algorithm is hosted on a secure, web-based application which partner financial institutions have access to.

- The app can be accessed from smartphones, tablets and computers to complete loan applications by filling in required data forms including personal details, loan details, borrower history and other employment and financial details.

- The algorithm assigns a score between 0% (lowest risk) and 100% (highest risk) for each loan application.

Evidence of Success: Differentiating Credit Risk

Over 2019, a Uganda EduFinance partner financial institution piloted the school fee loan algorithm. Loan officers did not make disbursement decisions based on the algorithm score for the pilot, enabling EduFinance to compare lending decisions & outcomes to scores/predictions.

Our analysis found that the credit algorithm could successfully differentiate risk.

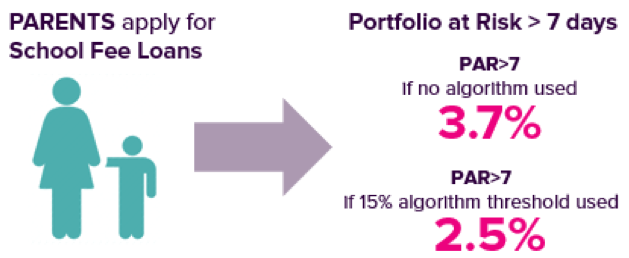

For example, if school fee loans had only been disbursed to applicants with an output score of < 15%, the portfolio at risk (PAR) more than 7 days for loans disbursed would have been 1.2% points lower. See Figure 2. While a lower threshold may affect the volume of loans approved, this example demonstrates that the algorithm can successfully differentiate risk, and as more data improves the quality of the algorithm, the model can be optimized for profitability by each financial institution, depending on risk appetite.

Figure 2: PAR>7 days 1.2 % Points Lower if Algorithm Threshold Used

Based on our analysis of the 222 school fee loan applications, there is evidence that a financial institution could incur savings resulting from reduced delinquencies and reduced manual task load if the algorithm was used in the approval process.

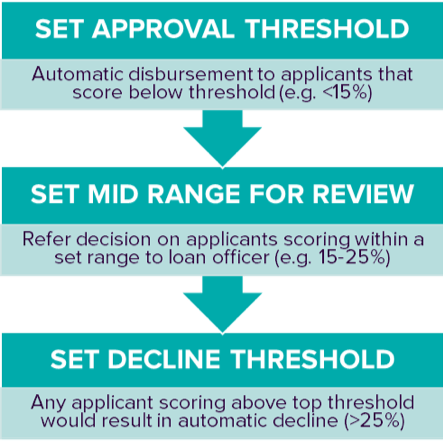

Figure 3 below is an example of a potential integration of the output scores into the approval process:

Figure 3: Algorithm Approval Process

Additional findings indicated an alignment between loan officer decisions and the algorithm scores:

- Loan officers approved applicants that scored less risky in the algorithm

- Of the applicants scoring higher risk, a greater portion of loans were not disbursed than disbursed

Of the school fee loans that were disbursed, findings indicated the algorithm could consistently differentiate risk:

- The algorithm had higher average scores for loans that fell in arrears during 7 of the 8 months during which there was delinquency

- Higher scores proved riskier in the overall disbursed loan sample

The EduFinance Credit Algorithm: Going Forward

As more loan applications improve the richness of data, we will continue to employ machine learning to make improvements to the existing models. We are working with those financial institutions to embed the process for regular use. We have developed our web-based application for scale to other markets and will soon be deploying EduFinance algorithms to financial institution partners in Rwanda and Pakistan. Financial institutions that are interested in exploring the potential to develop an algorithm based on their portfolio and market can inquire through their EduFinance representative or through edufinanceadmin@opportunity.org.

To find out more about the EduFinance Credit Algorithm read our Key Insight here!

Opportunity EduFinance Technical Assistance

Opportunity EduFinance’s technical assistance facility (ETAF) has partnered with 53 socially focused financial institutions in 22 countries to provide the expertise, training and support needed to launch and grow sustainable education finance portfolios. To date, our partners have disbursed over US$290mn in education loans, and are currently lending to 13,000 affordable private schools and over 103,000 parents.

Leveraging twelve years of experience working with financial institutions on education lending, the EduFinance Technical Assistance team offers financial institutions a suite of customized modules, including market research, product design, staff training, portfolio analysis, and now the EduFinance credit algorithm.

For additional information, please visit us at https://edufinance.org/what-we-do/technical-assistance.

For specific inquiries, please contact edufinanceadmin@opportunity.org.