'Preparation is key. Always anticipate.' How one financial institution in Rwanda is handling the COVID-19 crisis

Opportunity EduFinance recently spoke with Arah Sadava, CEO of AB Bank Rwanda about how they are coping with the current pandemic and continuing to engage clients.

Thank you for speaking to us Arah. Could you tell us about the initial steps AB Bank Rwanda took to respond to the COVID-19 crisis?

I was working at Access Bank Liberia when the Ebola pandemic happened. We were evacuated but I learned a number of lessons operating a bank during a regional pandemic. Because of my experience in Liberia, myself and my senior management team at AB Bank took actions in early February, even before there were any COVID-19 infections in Rwanda.

I was working at Access Bank Liberia when the Ebola pandemic happened. We were evacuated but I learned a number of lessons operating a bank during a regional pandemic. Because of my experience in Liberia, myself and my senior management team at AB Bank took actions in early February, even before there were any COVID-19 infections in Rwanda.

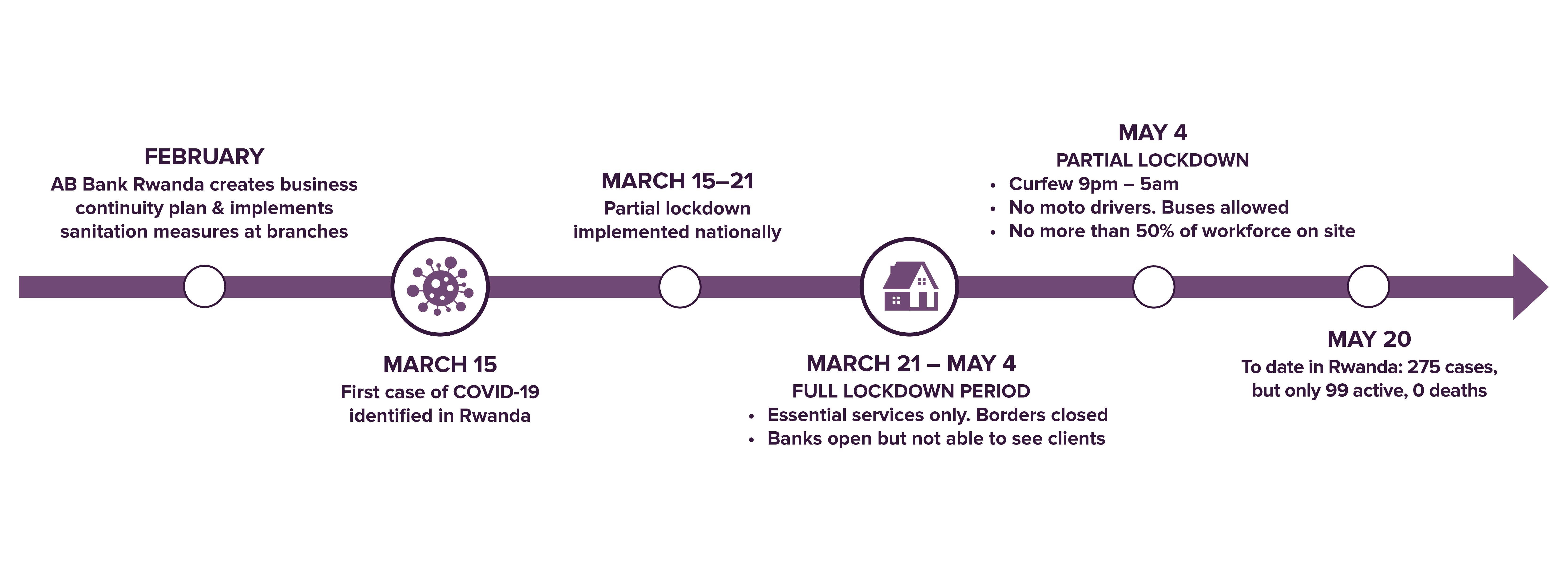

The team prepared a Business Continuity Plan, which included implementing and washing stations in front of all branches, and purchasing sanitizers for staff and clients in branches. We already had a cash management plan because we all know from experience that what you need to focus on in times like this is actually liquidity. Liquidity issues eat into capital, and there you go.

Comparing this experience to your experience during the Ebola pandemic in West Africa, what were your key learnings that are most applicable now?

Preparation is key. Always anticipate.

In Liberia, I actually prepared an entire procedure manual with protocol on what to do if a client collapses in a banking hall, which they didn't previously have. This ended up happening in a banking hall, and the protocol was already in place and used to help the staff address the situation appropriately and properly help the client.

I brought these types of preparation learnings with me to Rwanda. My experience in Liberia is one of the reasons we were prepared early on when COVID-19 was first identified as a potential issue. For businesses around the world, we know that many had never considered a contingency plan for a crisis of this magnitude prior to the pandemic. Many businesses were uncertain how to rapidly transition staff to remote operations.

Making Immediate Changes

We have now given selected heads of departments banking system access so they can still view the system remotely. Auditors also have remote system access to monitor for any red flags. We also immediately implemented software that prevents cybersecurity attack and fraud.

I say "Always think ahead." Many businesses aren't currently thinking about a 'new normal.' They don't think this crisis is going to last long. I told my heads of departments that we have to come up with a new way of doing things because this isn't going away.

Can you briefly describe your lending operation model prior to the impacts of COVID-19?

Prior to the pandemic, AB Bank Rwanda used a traditional microfinance institution (MFI) model, with field staff interacting with clients in-person at three different levels: loan product promotions, loan application & assessments, and field visits for loan monitoring. We use a customer-centric approach. Our business officers do sales for savings products as well as loans.

What is the ‘new normal' for AB Bank Rwanda?

Our team recognizes that COVID-19 is not going to go away in a few months. We are still putting quite a number of changes in place as part of our expectations for a 'new normal’. During the lockdown, we instituted many changes. Everyone is on remote work, apart from three people in the branches: manager, teller, and someone front of house. We have also put in protective glass and markings on the floor for social distancing.

Digital Transformation

Before COVID-19 we were planning to go digital but we did not have a digital platform in place yet. The biggest immediate challenge was how to deal with the fact that clients couldn't pay us [in-person] during lockdown. During the full lockdown, we opened an account with MTN and were still able to receive 30% of our repayments through this account, which we then reconciled with our client accounts manually.

At the same time, we pushed through the entire process to put mobile money in place in just six weeks. This included all the API links to our system - it is now all digital.

We are also going to do more digital promotion through SMS, WhatsApp and Facebook. Given the crisis, people are very dependent on messages from their phones and also on the radio in rural areas.

Client Support

In order to help our clients we offered them a grace period. We didn’t start any restructuring yet because we still have to make sure the business is running. We removed penalty fees and most of the transaction fees.

When we transitioned back to partial lockdown after May 4th, we started a client survey of who is still doing business using our call center and business officers. We have also produced a white list of sectors we can safely re-enter for lending. We are trying to be careful in lending because of the crisis – this is an import-based country with closed borders that impacts many businesses. We will limit client interface and are analysing previous data to see who our low-risk clients are and decide who can qualify for a repeat loan.

How are you continuing to engage and train your field staff during this period?

Our Business Continuity Plan includes business communication protocol with the staff, mostly through WhatsApp. Our 'mother company', Access Holding, is also helping by using experiences from our sister banks. They already have the most relevant training materials related to digital lending uploaded to an online training system that staff can access through their smartphones.

We've prepared FAQ and a short procedural manual for our staff to understand the operational changes. So far, the staff are very much on board and have indicated support for the operational changes. Mobile money is readily used throughout much of Rwanda, so the transition to making digital loan repayments was not a brand-new concept for our clients and staff. We have asked some clients for feedback and haven’t encountered any major issues.

How do you see AB Bank working with school owners right now?

For many schools, everything in this crisis is new to them. They don't have a plan for managing or reopening. We've realized they don't know what to do and that they need help.

Our overall plan is progressive. Between June and August, we expect to start planning for lending to schools as they approach school reopening, tentatively set for September. Schools might need to implement unique measures, such as barriers around desks or more washing stations for children. We are open to lending to schools for these measures as they prepare for the start of the school year.

Arah Sadava assumed the CEO role at AB Bank Rwanda in April 2015. Prior to joining ABR, she was the Retail/Banking Services Manager of Access Bank Liberia from March 2014. She has more than 20 years of experience in microfinance and banking in over 9 countries, 7 of which are in Africa.

Arah Sadava assumed the CEO role at AB Bank Rwanda in April 2015. Prior to joining ABR, she was the Retail/Banking Services Manager of Access Bank Liberia from March 2014. She has more than 20 years of experience in microfinance and banking in over 9 countries, 7 of which are in Africa.

Arah started her career as a rural banking/ microfinance specialist in the Philippines. She later moved to East Africa to manage transformation projects. She then served for a well-known MF bank as the Chief Operations Officer initially in Tanzania, and then in Mozambique. In 2011, she joined one of the largest licensed MFIs in Cambodia as the CEO.