"Education is an enabler. Education opens doors. Education is an equalizer." 2022 Global Education Finance Conference

In November 2022 Opportunity International EduFinance hosted the Global Education Finance Conference in Nairobi, Kenya. Read the full Post-Conference Report here.

The best thing (about the conference) is that everyone comes up with such honest ideas. The challenges are very similar, but solutions are very diverse.”

- Kamran Azim, Taleem Finance Company (Pakistan)

This year’s Global Education Finance Conference brought together 155 attendees from 37 countries, including financial institutions, impact investors, development finance institutions, bilateral funders, researchers, and more.

We’re collaborating with Opportunity International to increase value for teachers and students in Indonesia – that’s the spirit of our organization.”

- Beril Adri Andea, Nusantara Bina Artha (Indonesia)

Of the 100 organizations represented, 79 were financial institutions from 22 countries across Africa, Asia, and Latin America. The conference theme ‘Investing in our Global Future: Growing Sustainable EduFinance Portfolios that Unlock Access to Quality Education’ highlighted the link between the business case for education financing and the aim of Sustainable Development Goal #4 – quality education for all.

CONFERENCE AGENDA

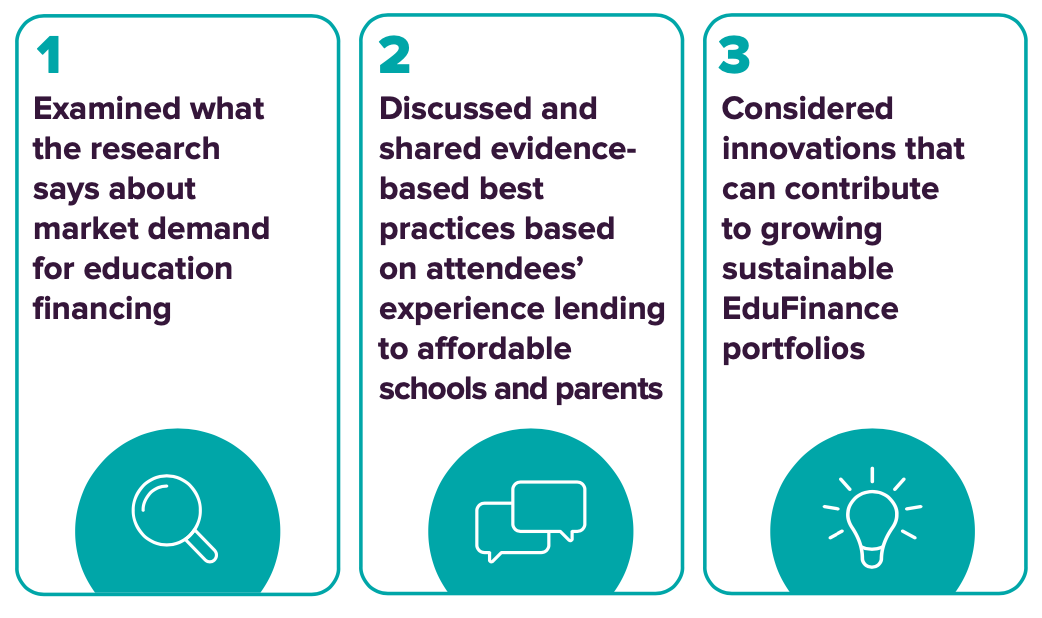

Over three days conference attendees –

The conference format was designed to keep all attendees in the room together for a wide range of peer-to-peer learning and knowledge-sharing opportunities. They raised challenging questions to presenters, panelists, and one another on how to solve common challenges and learn from the successes of other financial institutions lending in education. Attendees also took part in a networking reception, visited local schools, and left with new ideas and approaches to share with their colleagues.

DAY 1

On the first day, attendees received a pre-released copy of the latest State of the Affordable Non-State School Sector report and learned what the research says about market demand for education financing, estimated at US$36 billion. This includes the need to add 56 million additional seats for children in affordable non-state schools through 2025 to keep up with demand trends. They then took part in a range of interactive sessions on topics including:

- The EduFinance Market Opportunity

- Loan Products that Meet the Needs of Schools

- Unlocking the Barriers to Effective School Lending

- Growing a Profitable School Fee Loan Product

Panel Theme: Sharing Personal Experience: Education Lending & Why Education Matters

Panel 1:

- Kamran Azim of Taleem Finance Pakistan framed the mission in the context of the pandemic, stating the “vaccine” we are working on is education that will save future generations.

- Bunmi Lawson of EdFin Microfinance Bank Nigeria outlined the ways the bank addressed the many challenges brought on by COVID-19 and emphasized the opportunity to consider the full value chain for education lending.

- Sandeep Wirkhare of Indian School Finance Company reflected on the opportunities in technology to advance education lending, from lowering operating costs, and reducing approval time, to providing digital school fee collection platforms.

- Roberto Gimenéz of Fundacion Paraguaya pointed to the way the pandemic showed the many needs existing within the education sector, from infrastructure and working capital to investments in technology and developing trust between schools and financial institutions. “It is worth it to be here and worth it to bet on education.”

Panel 2:

- Simón Ziba of Vision Fund Zambia reminded everyone that education is not a given for many children, and yet education is the best equalizer in a society.

- Atul Tandon of Opportunity International shared his personal educational journey that started in India. He posed the question of how we create systemic solutions to structural problems that limit access to quality education for all.

- Emilio García of Coopsama Guatemala explained that thanks to the effort made by his dad he was able to attend school and educate himself.

We must maintain spaces for reflection and the search for strategies that help us, as institutions, to make a real contribution to improving the quality of education in these countries.”

- Gladys Caraballo, COOP CDD (Dominican Republic)

DAY 2

Day 2 included sessions on a further range of interactive sessions and topics including:

- Growing your Education Finance portfolio

- Increasing the Profitability of your Education Finance Portfolio

- Innovative Education Finance Products

- Financing Schools Beyond Collateral: A Digital Solution

- Limiting Arrears of my Education Finance Portfolio

- Funding my Education Finance Portfolio

- The Financial, Marketing & Social Benefits of Improving School Quality for Lenders

One of the ways EduFinance supports financial institutions to grow Education Finance portfolios is through the ‘School Leadership Academy.’ These workshops aim to increase lending to unbanked schools by bringing together school owners and financial institutions. Financial institutions that have participated in School Leadership Academy workshops to date shared their experiences.

When you bring school owners together you are able to hear different experiences and learn from each other. We got to understand this thanks to the workshops”

– Chilufya Siansangu, EFC Zambia

A role play set in a local branch office where an unbanked school owner sought information from a very unhelpful loan officer provoked laughter from the audience, while also resonating with attendees that further shared their takeaways:

- Loan officers need to be trained, not only on the ‘script’ but also how to handle people. If you don’t build this capacity within your staff, you will lose clients.

- The biggest challenge is the [staff] mindset. There needs to be a value besides the loan, like mentorship, training, etc.

- The business is not financial; it is a service...as leaders you can have the vision, but you have to align with the rest of the work team.

Attendees also reflected on a range of innovative Education Finance products, including gender-centric products offered by Kashf in Pakistan to school payment platforms such as SchoolPay enabling cash-flow based lending approaches. Oiko Credit and Blue Orchard then shared ways financial institutions could apply for capital to fund new and growing Education Finance portfolios.

DAY 3 – SCHOOL VISITS

On Day 3, attendees were offered the chance for a field trip to a local school in Nairobi. Dividing the group between two school locations, school owners graciously shared not only their school’s origin story, but the details of how they funded, grew and continue to invest in their school. They shared their vision for their schools, the challenges of buying land, and the number of girls they provide monthly sanitary napkins to because they wished someone had done it for them. They brought to life what a school actually is and can be – a safe, supportive, enabling environment for all learners.

Education is an enabler. Education opens doors. Education is an equalizer. With education comes improvement and development.”

- Mojisola Opebiyi, Bowen MFB (Nigeria)

NETWORKING

Peer-to-Peer learning is core to the EduFinance model. Financial institutions working to build sustainable EduFinance portfolios are best positioned to share their experiences and learnings to benefit the Opportunity EduFinance partner network. Attendees exemplified this commitment to networking and peer-to-peer learning throughout the conference, willingly sharing experiences, and challenges and asking questions of their peers across different countries and regions. The Networking Reception provided attendees with a further opportunity to continue these deep-dive discussions.

A great opportunity to meet different people from different continents, and I will definitely be keeping in touch with Opportunity International.”

- Andualem Hailu, Hibret Bank (Ethiopia)

ATTENDEE FEEDBACK

At the end of the conference attendees shared that they were now looking at education financing differently to other lending and that they had realized the opportunity financial institutions have to mentor and advise school owners for a greater impact. The post-conference survey also asked attendees to share “What actionable information did you learn that will help you in your work life?” Their responses included:

- How to add non-financial services to support schools

- Digital approaches to school fee lending

- Huge market size for education financing, creating a huge opportunity for funding

- Growing education finance portfolios through information sharing and exchange of experience

I was able to connect with many other institutions, share experiences and learn from each other. Can’t wait for the next!”

– Roberto Gimenéz, Fundacion Paraguaya (Paraguay)

Read more about the State of the Non-State School Sector Report in our blog.