Antonella Shares Insights into the Education Lending Market in Rwanda

Opportunity International EduFinance recently conducted market research into the affordable private school sector in Rwanda. The objective of this new research was to take a fresh, deep-dive look into an affordable schools market EduFinance has been engaged in for over 10 years. As we plan to expand our support for Rwandan schools to grow and develop, up-to-date market knowledge is essential to increasing school’s access to financing through new partnerships with socially-focused financial institutions in Rwanda.

Antonella Abategiovanni works on the EduFinance Technical Assistance Facility (ETAF) team which conducted the research to produce our Rwanda Market Knowledge Report (click here to view summary). I sat down with her to discuss the importance of market research in ETAF’s technical support for financial institution partners and to hear her thoughts on the most interesting findings that will guide our Rwandan partners to provide the most relevant, tailored financial solutions for schools and parents.

Antonella, ETAF Associate

Antonella, ETAF Associate

Thanks for taking time to discuss this market research with me Antonella. Could you start by briefly explaining how the ETAF team and market research works towards our mission in Rwanda: to get more children into better schools?

Through our Technical Assistance team, we offer technical support to partner financial institutions that are socially-focused to help them to create a sustainable education lending portfolio. Among the different areas of assistance we provide, market research is the first. It is very important for a financial institution to first understand the unique market demand for education lending products in their operational regions in order to successfully launch and or grow their education portfolio.

According to the 2018 Rwandan Ministry of Education statistics, the human resources in the education sector represent 31% of the whole population - estimated to be 12 million. The education sector, therefore, plays a critical role in the development of Rwandans. The small country in eastern Africa has an estimated 2,150 private schools serving around 330k students, representing more than 16% of the total schools and, 9% of the total student population, according to our Affordable School Market Report.

By conducting interviews and focus group discussions with local school owners, teachers and parents, we have the opportunity to elevate their direct needs for unique financial products to our partners. We work to ensure these stakeholders have a voice at the table and are at the center of each aspect of product design and loan officer training. We understand that showing real market demand incentivizes partners to start or increase their education lending, which leads to more classrooms and facilities being built, more parents able to pay school fees when they are due – ultimately better access to education for more children.

-lpr.jpg) EduFinance partner school, Rwanda

EduFinance partner school, Rwanda

So the role of partnering with socially-focused financial institutions to help grow a sustainable education portfolio is key to our mission, with the first step of this process being market research. Could you explain how we collected this research in Rwanda in more detail?

In each new market, we partner with financial institutions and perform market research in targeted areas of the country. In Rwanda, we interviewed 150 schools with an average of 469 students per school. We also interviewed 150 parents with an average of 2 children in education. Both types of interviews were conducted across three main regions: Kigali (Rwanda’s capital), northern province and southern province.

We asked questions like ‘how do you as parents manage your children's school fees’ or ‘how do you as a school owner manage your cash flows over the year’. It takes roughly 6-8 weeks to fully conduct our market research, including the interviews.

How is the market research findings used by the ETAF team?

A market-driven study is very important to get insights into the habits and needs of the key stakeholders. In Rwanda, we investigated the fundamentals of education finance: borrowing behaviour, parents willingness to undertake a loan to pay school fees, school capital improvement needs and additional financial services (i.e. savings products, fee payments management, etc.).

We first collect all this valuable information to estimate the potential market size and then produce a final comprehensive report and presentation. Our team then presents the findings and recommendations to our financial institution partners and then, in collaboration with them, we design tailor-made products to improve existing financial services or launch a new education portfolio.

This time we found that the estimated total market size in Rwanda for School Fee Loans was RWF 21 billion (US$23.2 million); for School Improvement Loans was RWF 40 billion (US$44.2 million) and the School Fee Administration and Payment Services were RWF 860 billion (US$951 million).

That certainly sounds like a potentially sizeable market. How important is this data for stakeholders including the financial institutions, schools, parents and students?

We usually conduct market research to improve existing products or expand a partners presence in new regions where we believe there to be high demand and need. We help financial institutions to offer financially inclusive products to serve affordable local schools and parents in need of financing solutions to support their children’s education. Each piece of market research is country or region-specific, as well as specific to the financial institution, so this helps us to design a product to meet demand better. For example, through our research, we may find groups that do not currently have access to finance but want a loan. We can then include these groups in our product recommendations to the partner.

What was the most interesting and useful finding the Rwandan market research brought up? Although we are not at the stage of product development yet, can you give an example of how a specific piece of evidence might be used to inform certain features of a loan?

There were two main takeaways from the market research in Rwanda for each main stakeholder:

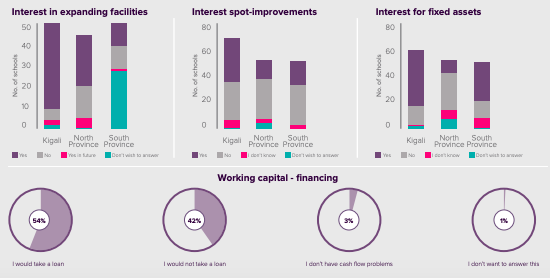

- Schools

- need financing to invest in their infrastructure (60%). School Improvement Loan demand can be split into two main categories. First, construction for extra classrooms to enroll more students and other school improvements such as plastering inside or outside the school. Second, School Improvement Loans can also be used as a remedy for cash flow - either short-term or, preferably, a long-term overdraft facility. About 54% of school proprietors interviewed would take a loan to solve their cash flow problems. There was also additional demand for financial products in liquidity management services and student fee collection through a financial institution.

Demand for School Improvement Loans, Rwanda Market Knowledge

Demand for School Improvement Loans, Rwanda Market Knowledge

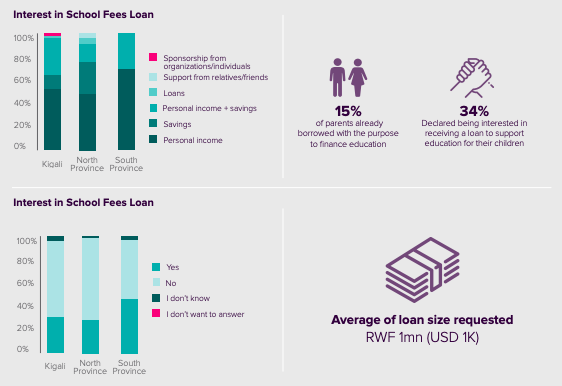

- Parents’ awareness of school fee loans is low, but 34% were interested in taking a loan to pay for school fees when asked. Most parents (63%) sending their children to affordable private schools in our sample had regular incomes from formal employment. There is an evident opportunity for loan officers to engage with new clients among those families interested in receiving school fees. We also found additional demand for financial products, such as school fees saving accounts for parents, and payment of school fees through a financial institution.

Interest in School Fee Loans, Rwanda Market Knowledge

Interest in School Fee Loans, Rwanda Market Knowledge

What was particularly interesting in this case was that the school was really willing to take a short-term loan to manage the mismatch in cash flow. Schools collect school fees termly (over three terms in Rwanda) but the expenditures they had. such as salaries, gas, electricity, and water were monthly. So, when parents do not pay on time all spending gets delayed. Although our advice would be that management of cash flow through a loan is not always recommended, we are able to design a product that does more than just suit the timing necessary to take out the loans - we also provide a mechanism behind the product.

For example, we can introduce collecting fees through the financial institutions by transferring directly from the bank account of parents and to the school’s bank account rather than the school sending money back to the financial institutions once the fees are paid. When discussed, switching payment methods was seen as a very useful and interesting tool to reduce transactions costs and time for parents and financial institutions by bringing the financial institutions into the mechanism of collecting fees.

What are the next steps and follow-up of aftermarket research?

The market research directly informs our collaborative product design process with the financial institution partner. Once the product is finalized and approved, we get to work hand in hand with the financial institution training the institution’s staff on education sector specific topics: from marketing, sales and client relationship best practices to credit and risk management of an education portfolio. Training builds on the capacity of the staff overseeing the education loan portfolio. We check how well our pilot project with the FI is running – we assess risk, determine whether the loans are high quality, and look at sales trends.

Listening to just some of the insights Antonella mentions provides a lens into the complex work ETAF carry out. Hearing her excitement about expanding our reach in Rwanda is truly promising. There are already 89 affordable private schools in our EduQuality program. These schools have joined the program in order to collaborate and learn from their peers by participating in a school cluster and commit to making improvements in their schools quality with the support of Education Specialists, training and resources. In fact, last year the first annual EduQuality Awards’ top prize was given to a Rwandan school in recognition of their exemplary innovative improvements in their school as part of their participation in the EduQuality program. Through our ETAF work we want to engage more financial institution partners in Rwanda to increase access to capital for more schools and parents, and to create a larger network of schools that can opt-in to our EduQuality program to focus on education quality improvements for their students.

Read our Rwanda Market Knowledge Summary here

Hope Carpenter is Opportunity International EduFinance Marketing and Communications Specialist. Since joining Opportunity International UK last year as a Monitoring and Evaluation Intern, she is now based in London creating and distributing marketing material for EduFinance. Collecting feedback and stories and from our global partners and team to share with EduFinance stakeholders is her primary focus.